Hola amigos,

Greetings from DC.

Another short post this week.

Two posts ago was 4000 words.

Last post was almost 2000 words.

And I kept this under 2000 again!

Let’s dive in.

Topic list:

Svetski on Liberty Lockdown

Hot streak in the snow?

Bitcoin’s birthday in Berlín

One year anniversary of my podcast

One year anniversary of Bitcoin ETF

Bond market tremors…

Svetski on Liberty Lockdown

Entrepreneurs make the world go round.

It’s probably no coincidence that some of my very favorite people in independent media started out as self-made millionaires before getting into commentary.

They walked the walk before talking the talk.

Clint Russell started out in telecom sales, but also studied economics, then became a private money mortgage broker managing a $100 million real estate portfolio.

Aleks Svetski started out by literally walking the walk. He first became a millionaire via door-to-door sales, then founded several companies, including Australia’s biggest Bitcoin exchange.

Clint became a podcaster in response to the 2020 lockdowns, reaching audiences with many millions of people in the years since.

Svetski is still an entrepreneur, but also became an author, and recently published his second book: The Bushido of Bitcoin.

I just helped Svetski get on Clint’s podcast for the third time. I’ll circle back to that new episode later in this post… but first, here’s a clip where they gave me a shoutout about an hour in:

“Shoutout to Jethro for spurring us to do this talk again. It’s been a year since I had you on… I’m sure he’s gonna be appalled that we didn’t talk about Bitcoin for the whole first hour.”

“Yeah, he’s a legend.”

I guess I won’t argue with that…

But I’d also like to highlight a quote from the second half of that clip about why Svetski wrote his new book:

“There’s a new socioeconomic paradigm emerging… Bitcoin. There’s gonna be beneficiaries that are gonna have a hell of a lot of wealth. And it’s not clear to me that they will be the kind of virtuous leaders that are necessary to guide civilization. I do believe that leadership is inherently important.”

Hot streak in the snow?

Before giving an update about my new telecom sales job, it’s worth mentioning that one of my favorite philosophers of all time is Albert Camus.

He won a Nobel Prize in Literature because, unlike most philosophers, Camus was a talented writer. Out of many brilliant quotes, this ranks among his best:

That quote goes so hard.

It came to mind because D.C. was just hit by its biggest snowfall in three years. That’s relevant because my new job isn’t just sales… it’s door-to-door sales.

Despite not being glamorous at all, there are a lot of things I genuinely like about this job. One, of course, is that it can be much more lucrative than people might expect. As I mentioned above, door-to-door is how Svetski first became a millionaire, even before he discovered Bitcoin.

But aside from the income, I also value the qualities that it’s forcing me to develop in order to succeed.

One of those is resilience.

Having a lot of money for its own sake isn’t enough. I want to develop into the version of myself that deserves to have a lot of money.

With that in mind, resilience was the most relevant quality for me this past week.

On the day after DC’s biggest snowfall in three years — at the same time as Clint and Svetski were recording that new podcast episode — I overcame the difficult circumstances to tie my personal record for most sales in a day.

Not too bad for a guy who struggled with adjusting to cold showers while living in El Salvador, where water heaters are still pretty rare.

A few minutes of cold used to feel hard. Now it’s pretty easy. I can handle several hours straight and still thrive.

Challenging myself led to improvement.

“In the depths of winter, I finally learned that within me there lay an invincible summer.”

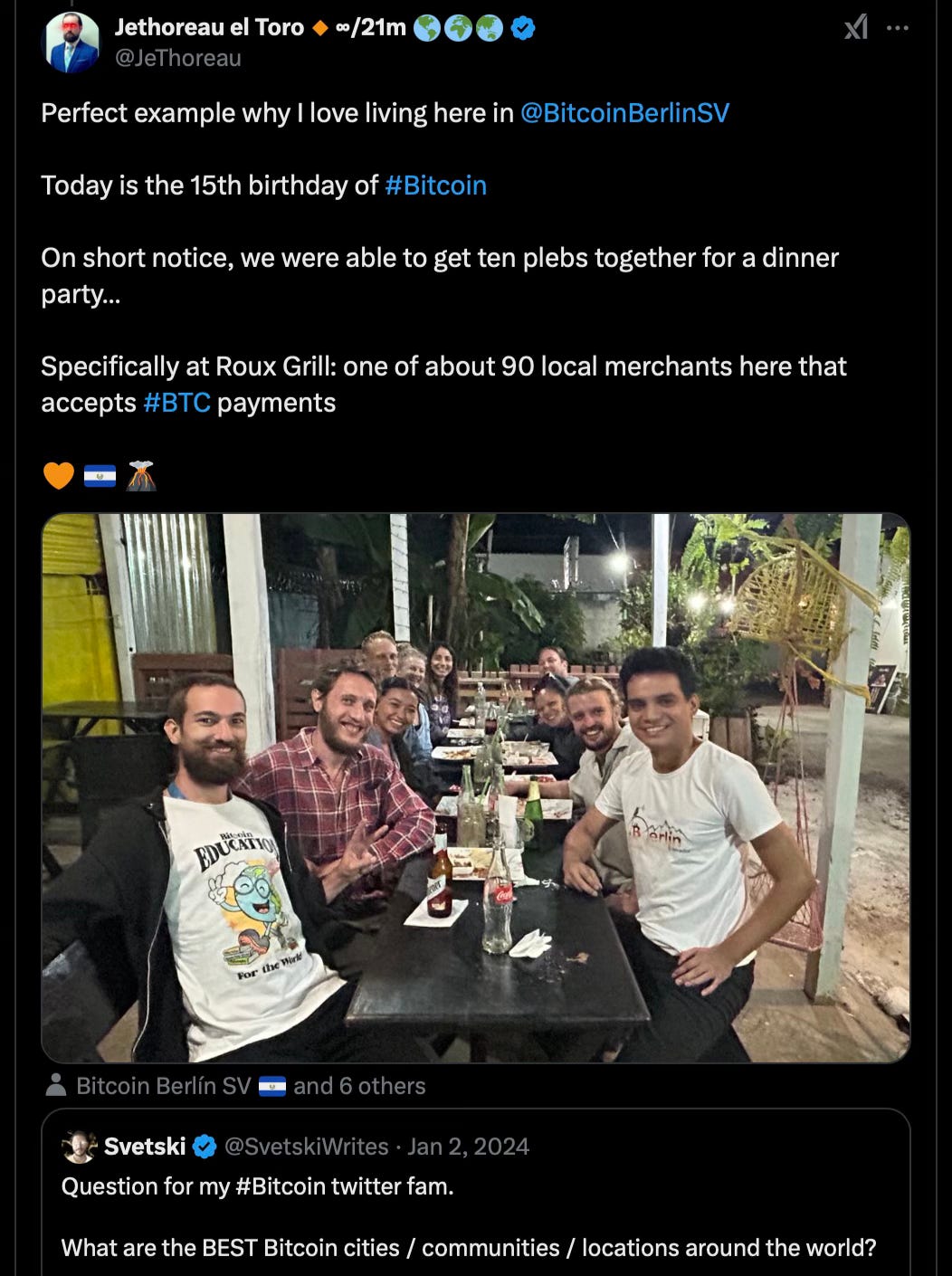

Bitcoin’s birthday in Berlín

January 3rd, 2009.

On that day, the world changed. On that day, Satoshi Nakamoto officially launched Bitcoin.

In the depths of the Great Recession, humanity learned that within us there lay an invincible solution to the fiat boom-bust spiral.

And on that date this year, Bitcoin just celebrated its Sweet Sixteen.

It was a Friday, so this year I personally “celebrated” by working and stacking more sats.

But it was a nice reminder of last year, when I celebrated properly with food, beers, and friends in the biggest Circular Bitcoin Economy within the world’s first country to make Bitcoin legal tender:

It was a heart-warming experience.

Also a literally warm experience:

T-shirt weather in January.

I’m not gonna lie. The past couple of days weren’t easy… seeing all the pictures of Bitcoiners at Max and Stacy’s golf tournament in sunny El Salvador while I was working long shifts in the snow.

I could be back in El Salvador.

Right now. I could be there.

It was a bear market when I first moved to El Salvador in August 2023. Despite having less total Bitcoin now — after my eight month mini-retirement, living on savings there — my purchasing power in dollar terms has actually increased.

I could be in tropical Bitcoiner paradise.

But for now, the U.S. is still the best place for me to continue growing. Before I return, I’m building more skills, earning more capital, and (perhaps most importantly) developing more character.

One year anniversary:

my podcast

Speaking of El Salvador and anniversaries…

Friday — one week after Bitcoin’s Sweet Sixteen — was the one year anniversary of my debut podcast.

I rewatched it recently.

And yeah, I’m a little biased…

But I think it aged really well!

All four guests on that panel have achieved a significant amount of success in the business and/or media worlds.

All five of us like Bitcoin, liberty, and Austrian Economics… but the focus wasn’t on theory. It was more practical and tactical.

We talked a lot about growing businesses, growing audiences, growing communities… but also growing as individuals, and how that personal growth can feed into other goals at a larger scale.

It was a lot of fun.

And somewhat historic…

At the end — right before he flew to Iowa, where he had been invited to cover Vivek’s campaign for the first election in the Republican primaries — Clint announced that he had been asked to run for Vice President of the United States in the Libertarian Party.

I doubt many podcasts’ debut episodes feature breaking news like that. If I were naturally inclined toward self-promotion, I definitely could’ve gotten some viral attention for it.

That’s the thing though.

I already knew a lot about the tactics of growing a big audience. From afar, it looked like a career path that I would enjoy.

It wasn’t until I released the episode, however, that I realized I don’t really want to be famous… at least not yet.

Remember earlier how I said that I like people who walk the walk before they talk the talk?

I’m not ready for talking to millions.

I need a lot more experience, credibility, resources, and personal life stability before I even think about re-entering the front lines in the public battleground of ideas.

In the meantime, I’m glad that people like Clint and Svetski are ready and willing to cover important ideas and even controversial topics on a large scale.

I’ve mostly tuned out politics to focus on work, but I suggested several topics that I knew would be interesting for their blend of perspectives:

the global shift away from woke leftism

the new alliance and inherent tradeoffs between libertarianism and nationalism

the H1B immigration debate

what makes Western Civilization great

Svetski’s new book

Japanese “warrior code” and timeless virtues

If that sounds interesting to you, check out the full interview on Clint’s YouTube channel:

One year anniversary:

Bitcoin ETF

The day I recorded and released my debut podcast panel — January 10th, 2024 — turned out to be the same day the SEC officially announced their approval for Wall Street to launch ETFs for Bitcoin.

I don’t necessarily celebrate that.

Self custody and individual sovereignty had been major themes of the “Bitcoin ethos” through its first 15 years of existence. Wall Street taking custody of your investment doesn’t exactly line up with the ideals.

That being said, it was always inevitable that it would happen sooner or later. Just like nation state adoption, the ETF is a stepping stone toward Bitcoin becoming the world’s apex reserve asset.

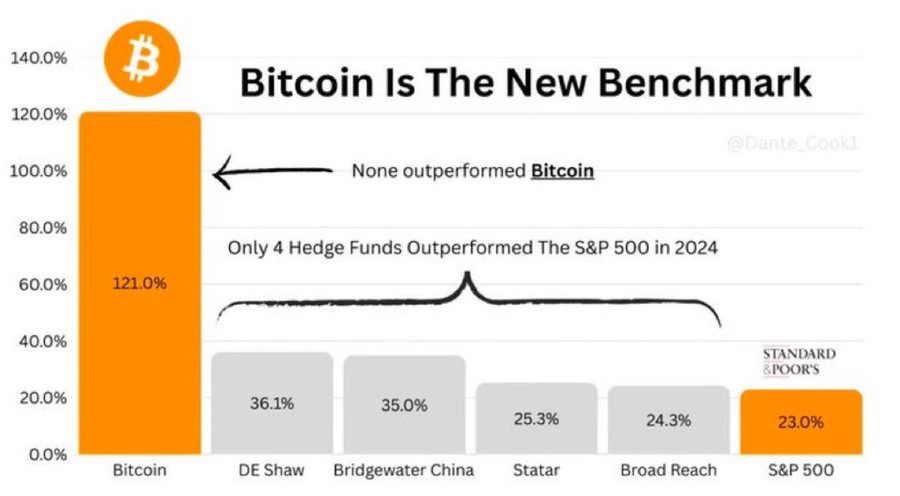

And the price has absolutely skyrocketed ever since.

Traditionally, the fiat price of Bitcoin has correlated with interest rates. For the first time, after the ETF approval — the most successful ETF launch in history — Bitcoin reached its all time high even before the Fed cut rates.

BTC ended up outperforming every single hedge fund in the world in 2024. And it’s still just getting started…

Bond market tremors…

The Bitcoin price increased significantly once President Trump was re-elected. As I covered two posts ago, Trump is the first pro-Bitcoin President of the United States. His son Eric is even predicting that the fiat price will reach a million dollars per Bitcoin soon.

A lot of Bitcoiners expect it to happen quickly. I think there’s a good chance of that, but I’m not entirely sure.

We live in insane macroeconomic times.

Central banks worldwide printed trillions during the Covid tyranny to keep the economy afloat despite lockdowns. It was a temporary bandaid, and years of inflation were the price that we all paid.

The Fed had to increase interest rates to slow down the inflation. The problem? It makes debt more expensive to pay off.

The U.S. national debt is over $36 trillion dollars. Several trillion will have to be refinanced over the next year. The interest on that debt is already over a trillion.

High interest rates make that debt even more expensive to service… and over the past week, the market price for new treasuries increased even more, not just for the U.S. but also for other major economies.

Suddenly the “risk free asset” doesn’t look so stable. And since government treasuries are the backbone of the entire global fiat system, it’s an understatement to call that a huge problem.

Ultimately, the solution will be even more money printing. But we might have a very steep debt deflation first. The Great Recession could look minor by comparison.

If that happens, the price of all assets would crash, and Bitcoin isn’t immune. I’m still buying as much as possible — and I think everyone should strongly consider allocating at least a small percentage of their portfolio into it — but I also think that individuals taking debt to buy more with the expectation of a quick 10x might get burned badly.

We’re in uncharted territory.

Nobody knows what to expect.

And I’m sure some powerful interests would love to see a crash right as President Trump takes office.

Either way, I’m focused on increasing my own income in a relatively inflation-proof role within a relatively recession-proof industry.

Whether or not economic winter is coming, I’m working on my own invincible summer.

That’s all for now.

I’m about to go even further North, up to New Jersey, to visit another office in the business I work for. It should be a fascinating experience. I’ll definitely have an update about that when I return and write my next post.

In the meantime… I’m focused on character development.

My 2025 journey has just begun.