Hola amigos,

Greetings from DC.

I wasn’t planning to write another post this soon.

After some extraordinary news though, Bitcoin’s fiat denominated price just crossed $106k — six figures more than the price ($6k) when I first started buying Bitcoin — so I decided that an update couldn’t wait.

Before getting into that news…

I’ve mostly been focused on getting momentum back with my new job, after taking time off for the El Salvador trip last month. This new income stream is how I’ve been able to buy more Bitcoin!

And it’s going pretty well. Two weeks ago, I ended with as many sales as the previous two weeks combined. And this past week, I ended up around the same total.

Cold streak = officially over?

Maybe not officially yet — I’m only back to average performance, not to my hot streak pinnacle, when I reached the Top 20 out of several hundred sales agents on this product campaign nationwide — but I’m on the right trajectory again.

I hate to get distracted from that positive momentum… but enough happened over the past two weeks that I decided a short post was necessary.

That short post grew into 3900 words.

I promise it’s worth your time though. Seriously. This topic list is absolutely unbelievable.

Let’s dive in.

Topics:

Eric Trump’s Bitcoin speech

El Salvador: gold TRILLIONAIRES?

MicroStrategy enters NASDAQ

Strategic Bitcoin Reserves

(State level + Federal on Day One?)

Important Sales Lesson

3 podcast episodes:

Jack Mallers on Timcast

Roger Ver on Tucker Carlson

Guy Swann vs “Hijacking Bitcoin”

My own experience with Bitcoin’s real world utility

Eric Trump’s Bitcoin speech

I can hardly believe this is real.

Two weekends ago, the son of the new President of the United States flew halfway around the world to speak at a Bitcoin Conference in Abu Dhabi.

I’ve seen a LOT of Bitcoin speeches by this point. I’ve even given a couple of Bitcoin speeches myself. I’m not so easily impressed anymore…

But this one stood out.

It’s honestly surreal.

Here’s a 10 minute highlight cut…

I’ve already watched it multiple times:

The context is extraordinary:

President Trump spoke at the Bitcoin Conference in Nashville over the summer. At the time, he needed votes from the 50+ million U.S. citizens who own cryptocurrencies.

The cynical assumption at the time was that he’s just pandering… that he doesn’t actually support Bitcoin.

But that’s changed now.

President Trump already won.

Our votes aren’t needed anymore.

And yet the people around Trump aren’t backing down on their rhetoric. If anything, they seem to have become even STRONGER believers in Bitcoin.

Eric co-manages the Trump Organization.

He’s a trusted advisor to his father in business as well as politics. And his speech at the Conference in Abu Dhabi last weekend was even better than President Trump’s speech in Nashville.

The most surreal takeaway for me is that Eric Trump seems to legitimately grasp the real world utility that makes Bitcoin so valuable.

In order to appreciate a solution, you first need to understand the problem that it solves.

Eric’s family and friends have been affected by the political weaponization of the banking system. He actually understands firsthand the importance of self custody and permissionless exchange.

Eric has spent decades working in real estate development. He intuitively understands the importance of scarcity and property rights.

Eric has experience with international finance at the highest levels, working out deals involving billions of dollars worth of capital.

He appreciates the value of a highly liquid 24/7 market for transferring large amounts of capital globally… because he’s actually dealt with the fiat system’s inefficiencies.

Seriously…

Watch the 10 minute version.

This speech is NOT just pandering.

I genuinely believe that Eric believes in Bitcoin’s value, because he clearly understands the major problems that Bitcoin fixes.

Bitcoin fixes bank weaponization.

Bitcoin fixes the cost of inflation.

Bitcoin fixes inefficient capital flows.

And the fact that Eric delivered that speech in Abu Dhabi, of all places, just makes it even more surreal.

Rumors are swirling now that multiple Middle Eastern countries have started investing some of their money from oil — “black gold” — into “digital gold” with their massive sovereign wealth funds.

Buckle up.

Nation state adoption is accelerating.

El Salvador:

gold TRILLIONAIRES?

Speaking of black gold and digital gold…

Gold itself was humanity’s greatest form of money for thousands of years.

Civilizations around the world — many of whom had never even contacted each other — all converged onto gold as their apex form of money.

For thousands of years.

Independent of each other’s decisions.

They all came to that conclusion because its properties — scarce, divisible, durable, fungible, etc — made gold a better choice than every alternative.

After thousands of years, however, it finally lost to fiat currency because gold is too inconvenient to transport. As the speed and scale of commerce increased through the Industrial Revolution, gold simply couldn’t keep up.

Fortunately, we have Bitcoin as “digital gold” now, because it fulfills those same intrinsic properties even better.

It’s more perfectly scarce than gold… AND unlike transporting a physical metal, Bitcoin can move anywhere in the world at internet speeds.

All of that being said…

Gold still has value.

Its market cap still exceeds $17 trillion.

Central banks in particular still use it as a treasury reserve asset.

And here’s the crazy news:

El Salvador just discovered that they have an estimated three TRILLION dollars worth of gold underground.

TRILLIONS in value…

Just waiting to be mined.

President Bukele has already hinted on X that he plans to sell a big chunk of that newly discovered gold for Bitcoin.

It also seems like he’s made a new deal with the IMF for a loan to fund the mining operation.

We’ll see how it all unfolds…

But this is definitely a story to watch.

I wouldn’t even blame Bukele if he keeps some of that gold for treasury reserves. It might also be cool if he uses some of it to decorate the historic district in San Salvador. I’ve been to the Palace of Versailles in France. Even to a Bitcoiner, seeing so much physical gold in person has an undeniably impressive aura.

But there’s something poetic about exploiting the fiat system (IMF loan) to mine the original sound money… and then using a majority of that physical gold to acquire more digital gold.

Three years ago, El Salvador had a first mover advantage when it established a Strategic Bitcoin Reserve.

Now that other nations are starting to copy this Bitcoin strategy, the gold discovery feels like a gift from God to help El Salvador stay in the race leading this sound money paradigm shift.

MicroStrategy enters NASDAQ

Meanwhile…

Away from politics…

Michael Saylor is revolutionizing Wall Street. MicroStrategy’s corporate Bitcoin strategy has catapulted MSTR toward the top of the stock market.

Non-Bitcoiners are baffled, but Saylor’s thesis is actually pretty simple.

Huge amounts of capital aren’t allowed to be invested directly into an asset like Bitcoin. All of that capital is locked up in funds with requirements to invest in stocks and bonds.

By adding Bitcoin to MicroStrategy’s corporate treasury, Saylor realized that he could serve both of those requirements:

MSTR’s stock is a proxy for the upward volatility of BTC, with high risk but even higher returns than BTC itself

More importantly, MSTR’s convertible bonds are a stable way to gain positive Bitcoin price exposure

Considering how simple that thesis is, it might be easy to underestimate its impact. But we’re talking about an investment market with over a HUNDRED TRILLION dollars worth of capital that is now unlocked for Bitcoin exposure.

I repeat:

Over a HUNDRED TRILLION dollars.

More than 5x the market cap of gold.

MSTR is the bridge from all of that restricted capital into Bitcoin.

If it works, Michael Saylor could become the richest man in the world.

And it already is working…

MSTR just got added to the NASDAQ 100.

Now millions of normal investors — including many Bitcoin critics — who include NASDAQ index funds in their portfolio are thus indirectly invested in Bitcoin.

Think about that.

Everyone and their grandmother is now a Bitcoin investor, simply by having one of the most normal investments.

Mainstream adoption is underway.

And it’s likely to accelerate soon…

FASB just updated accounting standards in a way that incentivizes even more corporations to hold Bitcoin on their balance sheets.

A few have already copied MSTR.

We’ll probably see many more soon.

Buckle up.

Corporate adoption is accelerating.

Strategic Bitcoin Reserves:

It’s not just El Salvador.

Not just the OPEC nations…

Not just Wall Street…

Strategic Bitcoin Reserves are coming to the United States very soon.

In his Nashville speech, President Trump pledged to establish a federal stockpile of Bitcoin for the U.S. Treasury.

Recent updates from people in his circle suggest that President Trump might make that move on DAY ONE after inauguration via Executive Order.

But it’s not just the federal level…

So far, two state legislatures have already introduced bills to form their own Strategic Bitcoin Reserves:

First came Pennsylvania…

And now Texas has followed.

For context, if Texas were a nation, it would have the eighth largest economy in the world.

A top ten economy…

Bigger than Russia.

Bigger than Italy.

Bigger than El Salvador.

Bigger than Canada.

(Yahoo Finance: “Texas proposes strategic bitcoin reserve to fight inflation”)

Even if the bill doesn’t pass right away, it feels like only a matter of time now. The United States is moving toward Bitcoin accumulation at a federal level, and individual states are starting to follow as well.

That’s who I’m competing with now.

That’s who YOU’RE competing with.

THAT is why I’ve become laser focused on buying as much Bitcoin as possible, as quickly as possible… while I still can at this bargain price, before these massive entities officially enter the market.

Speaking of buying Bitcoin…

Here’s a lesson from my new job.

Important Sales Lesson:

Everyone hates sleazy salespeople.

The ones who are pushy…

The ones who are dishonest.

To be clear:

That’s NOT me.

One reason why I like my new job is that I get to ethically sell a legitimately great product.

The client is the only internet provider in the entire region with fully fiber optic lines. It’s objectively the highest quality product for a technology that nearly every household uses.

And most of the people whom I’ve signed up were actually being overcharged anyway by their previous providers… so in most cases, I’m actually able to help lower their monthly bill.

Better quality.

Less expensive.

Legitimately helping people!

And that mindset — helpful, not sleazy — is probably why I have the lowest cancel rate out of everyone in my office.

When I help people sign up, they actually follow through with the installation, because it wasn’t a trick. I actually made sure first that the change would legitimately benefit them.

But here’s the lesson:

A surprising amount of potential customers choose to decline the deal anyway.

They’ll trust me enough to tell me their current bill.

They’ll understand the basic explanation that fiber optic technology is better than the old copper wires.

The logic checks out…

But that’s the thing.

Sales isn’t always about logic. Certainly not to the extent that we might like to believe, as ostensibly rational human beings.

I’ve still closed many similar situations, so it’s not just my fault either. During my hot streak, less than two months into the job, I already reached the Top 20 out of several hundred reps… I’m not exactly bad at this.

But sometimes there’s nothing I can do.

Maybe the prospect is too busy.

Maybe they’re distracted.

Maybe they don’t like change.

Maybe they need to consult another decision maker.

And to be fair…

Sometimes it’s partially my fault.

Maybe the deal sounds too good to be true.

Maybe I accidentally made them feel stupid about overpaying so badly for inferior quality with their current internet provider.

But why do I bring all of this up here?

Because the same exact principle applies to convincing people about Bitcoin.

The logic of buying Bitcoin is obvious at this point.

You’ve seen in the rest of this post how many major institutions now agree: investing in Bitcoin has NEVER been LESS RISKY than it is now.

Even BlackRock now officially recommends a 2% portfolio allocation. That’s not financial advice from me… it’s official advice from the world’s biggest asset manager.

And the son of the new POTUS just publicly declared his expectation that Bitcoin’s price increases 10x from its current all time high to over $1 million.

The investment logic has never been more obvious.

But convincing people to start buying isn’t just about the logic. It’s also about personal factors such as timing and emotional rapport.

Sales is often defined as the transfer of belief over a bridge of trust.

The prospect has to trust you.

And not just your rhetoric…

They also have to trust that you understand their situation, and trust that you have their best interests at heart, in addition to trusting your subject matter expertise.

I think a big part of why I failed so badly at convincing most of my friends and family to buy Bitcoin when I started — when its price was just $6k — is because I didn’t build enough trust.

I focused too much on its libertarian ideological roots… I didn’t focus enough on how it benefits THEM… and I wasn’t living a lifestyle that seemed credible or worth emulating.

I was logically correct.

I’ve been proven correct.

But logic wasn’t enough.

Is it too late now?

The price per Bitcoin is six figures.

Its market cap is over $2 trillion.

Satoshi Nakamoto’s Bitcoin holdings have now made him the 15th richest person in the world… just ahead of Bill Gates.

So back to the question:

Is it too late to start stacking?

On the contrary, I think the rise of Bitcoin is still just barely getting started.

If the Bitcoin thesis is correct, then it will become the apex reserve asset — the unit of account and the bank settlement “base layer” — for the entire global economy.

About a QUADRILLION dollars worth of assets would be repriced from dollar terms into Bitcoin terms.

The new market cap of $2 trillion might seem like a lot, but it still has a LONG way to go if it’s gonna absorb a quadrillion dollars worth of value.

So no… it’s not too late.

But I don’t recommend going all in either. Not without understanding what you’re buying first.

I’m about to recommend three new podcast episodes.

The first is shamelessly pro-Bitcoin. It represents the same “Bitcoin maximalist” perspective that I generally share.

But in the spirit of full disclosure, the other two episodes feature early Bitcoin adopters who now oppose the direction that the asset has evolved in.

Three podcasts:

Jack Mallers on Timcast

Roger Ver on Tucker Carlson

Guy Swann vs “Hijacking Bitcoin” coauthor on Liberty Lockdown

1. Jack Mallers on Timcast

Two posts ago, I mentioned how I had the chance to go on Timcast.

I decided that I wasn’t ready for the big stage yet.

So far, my Bitcoin advocacy has all been pseudonymous. I don’t mind using my face semi-publicly, but I also don’t crave attention from a million strangers scrutinizing every detail of my life…

Not to mention potential legal ramifications while I’m still making sure that my Bitcoin tax history — which was complicated by actually spending some of it as money, instead of only investing as an asset — is safe from IRS scrutiny.

Jack Mallers IS ready though.

He’s a couple of years older than me. He’s been involved in Bitcoin for over a decade, with a significantly bigger stack than mine. He’s been running his own Bitcoin exchange company with proper audits, so he’s fully free to speak his mind without fear of the IRS targeting him.

Jack can afford to focus on evangelism.

And a few days ago, he absolutely crushed this opportunity that I could have had:

Jack did a phenomenal job.

He also deserved the opportunity more than I did anyway, to be honest. Tim is fascinated by El Salvador’s story — they talked about it a lot in this episode — and Jack Mallers is the one who helped President Bukele write their Legal Tender Law.

For now, I’ll just settle for that time Clint Russell gave me a shoutout by name on Timcast when I first moved there:

2. Roger Ver on Tucker Carlson

Speaking of being targeted by the IRS…

Roger Ver was an early Bitcoin adopter whose evangelism was so impactful that he was widely referred to as Bitcoin Jesus.

Unfortunately, this asset has a complicated history, and so does Roger.

The technical development of Bitcoin went through “The Blocksize War” between 2015 and 2017. It culminated with multiple other versions of Bitcoin being “hard forked” into separate cryptocurrency projects.

Here’s the crux of the debate:

Originally, the inventor Satoshi Nakamoto described his project as “peer to peer electronic cash” in the 2008 white paper that introduced Bitcoin to the world.

However, Satoshi also hardcoded a limit on how much data could be included within each block in the blockchain. This makes it impossible for billions of people to actually transact with Bitcoin on its base layer.

Without going into too much technical detail, this created a clash between the original vision and the reality of how the invention actually works.

Some people wanted to increase the block size limit. Others knew that the change would undermine Bitcoin’s uniqueness as the invention of absolute digital scarcity.

The absolute scarcity camp won, and “BTC” Bitcoin became the “digital gold” reserve asset that is now starting to revolutionize the world’s financial system from within.

But the “peer to peer cash” camp survived across multiple other coins.

Roger Ver was vilified by many — he went from “Bitcoin Jesus” to “Bitcoin Judas” — because he supported some of those forked versions.

Earlier this year, he even published a book called “Hijacking Bitcoin” to explain his perspective.

I disagree with Roger’s framing, but I’ll get into that in the next section.

The more important point for now is that Roger invested millions of dollars into Bitcoin early on… before the government had even defined how taxes would work for this brand new asset class.

Roger also renounced his U.S. citizenship a decade ago. He tried to pay the (outrageously un-American) exit tax to the best of his abilities.

But a few weeks after publishing his book in April — a few days after I returned from El Salvador to renew my passport, with the intention of moving back there full time to continue living on a Bitcoin Standard — Roger was arrested for tax evasion.

Even though I disagree with Roger about the way Bitcoin has evolved, I’m extremely glad that his case is getting national attention now.

Roger never hurt anyone. He never even intended to evade taxes. Now he’s facing over 100 years in prison.

This case is outrageous. It also sets an important precedent. Despite my disagreement with Roger, it’s honestly a relief that he got the chance to tell his story on the biggest political podcast in the world.

Tucker knows President Trump personally. Hopefully this leads to a Presidential pardon, and hopefully the new administration creates a less hostile regulatory environment for Bitcoin and cryptocurrency adopters.

3. Guy Swann vs “Hijacking Bitcoin” coauthor on Liberty Lockdown

Back to the Blocksize War…

I’ve actually been invited on two separate podcasts (“Practical Liberty” and “The Bitcoin Cash Podcast”) to have this debate myself. But I wasn’t involved in Bitcoin at the time, and I don’t really feel qualified to discuss the full history and all of the technical details.

The people who were involved at the time are mostly sick of the debate. They’ve been having it for over seven years, and most people in both camps now hate the other side.

But after Roger’s book and arrest, the conversation needed to happen again.

I suggested to Clint that he invite Guy Swann, host of Bitcoin Audible, back on his show for the eighth time… primarily to discuss the $100k milestone and Trump’s Bitcoin support, but also explicitly to address the “Hijacking Bitcoin” narrative.

Clint went one step further and invited Roger Ver’s co-author to debate Guy.

The result was 2.5 hours long. It’s worth watching if you really want to understand the tradeoffs that were made in Bitcoin’s design:

My own experience with Bitcoin’s real world utility

There’s so much I could say here.

I’ve lived the “Medium of Exchange” phase, using Bitcoin as “peer to peer cash” as much as possible with the Lightning Network in El Salvador.

I’ve experienced the “Store of Value” upside of “digital gold” as an investment.

I could say a lot more about the Blocksize War debate.

But the more important comparison isn’t Bitcoin versus other cryptocurrencies… it’s Bitcoin versus fiat currency.

And that brings me back to Eric Trump’s speech.

“Digital gold” might not be private enough for tax evasion or black markets… it might not enable true self custody for billions of people.

But it nonetheless solves the biggest problems with the existing fiat system.

It can’t be inflated.

It can’t be confiscated.

It can’t be censored.

But perhaps even more relatable for normal needs… it simply works better. And I have a real world example.

My new job pays on Fridays. I haven’t set up direct deposit yet (my fault, to be fair), so I get physical checks.

My fiat bank’s app allows me to deposit checks via picture though, so no problem, right?

Ha. I wish.

The fiat system might feel fast when you swipe or tap your VISA, but behind the scenes, it works in layers. And when you have to interact with those lower layers, you realize that they’re horrendously inefficient.

Checks take multiple days or even weeks to fully clear. Sometimes that’s no big deal… but when you need the money for a time-sensitive investment, and your bank is closed for the weekend, that inefficiency can cost you.

In the case of my recent paycheck, waiting a few days cost me less than a hundred dollars, as Bitcoin’s price increased.

But when you’re allocating capital at the scale of someone like Eric Trump, those delays can cost millions of dollars worth of value in time-sensitive investments.

Bitcoin simply works better.

Maybe not for buying coffee in a fully self-custodial way… but that’s where “Big Blockers” like Roger Ver are missing the point.

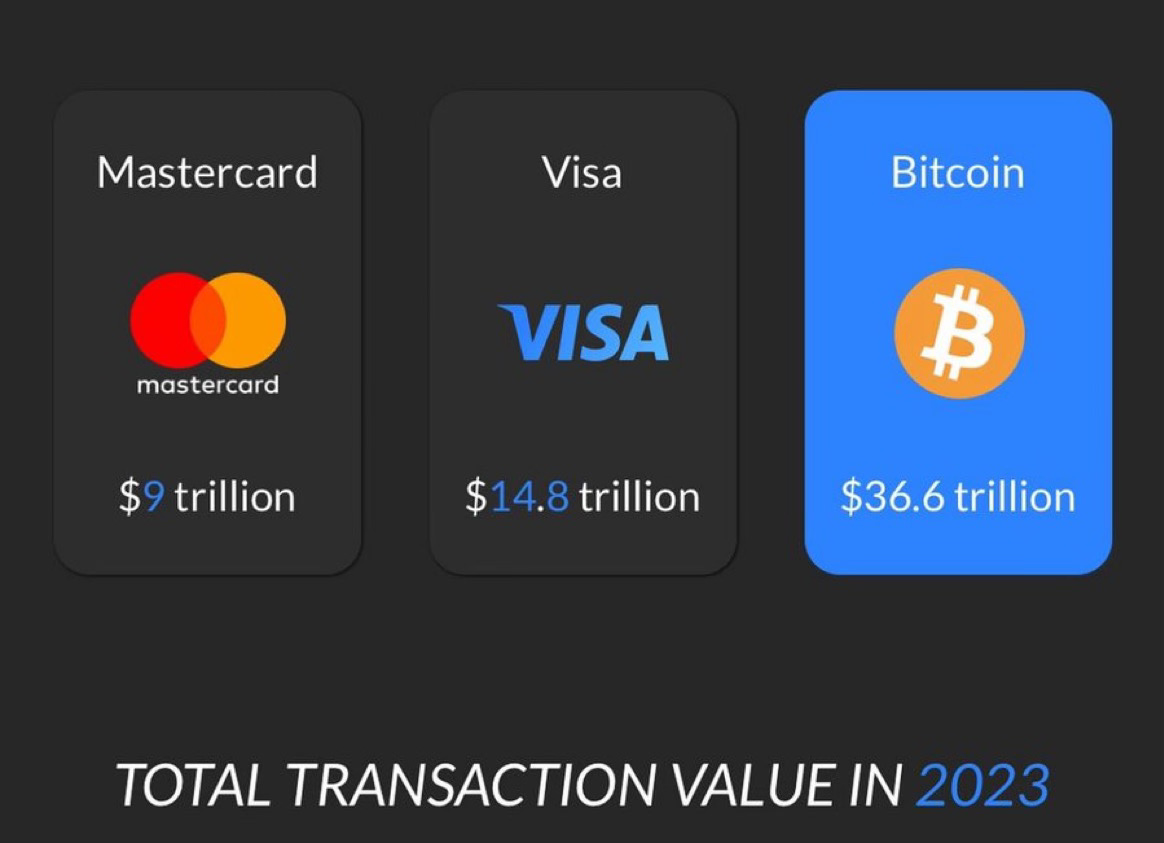

Bitcoin makes large transactions more efficient. Even though VISA and MasterCard process more small payments, Bitcoin processed more total value than VISA and MasterCard COMBINED last year:

An immutable unit of account that can’t be inflated and ALSO makes the entire financial system more efficient 24/7 is still the most valuable invention in the world.

It might not make banks and governments obsolete, as many libertarians had hoped… on the contrary, it actually seems like it might make banks and governments more efficient.

And those massive entities have started to realize this. That’s why they’re suddenly very interested in buying Bitcoin for themselves.

So I’m focused on getting more of it for myself while it’s still available at such a bargain price.

I won’t dwell on the Blocksize War.

I won’t chase the daily news cycle.

I’m even going to remove X from my phone again for a while… the hot streak in my new job happened during a multi-week Twitter detox.

My number one focus between now and the inauguration of President Trump in January is to buy as much Bitcoin as I possibly can.

If you choose to join me in front-running trillion-dollar capital influxes… Jack Mallers’ exchange Strike is one of the best ways to buy Bitcoin. It works in the UK and several other countries as well as the U.S.

Feel free to use my referral code.

And since it will probably be at least a couple weeks before my next post… in the meantime, Merry Christmas!