Hola amigos,

Greetings from D.C.

This was supposed to be a brief post. I still managed to keep it to just 2134 words! Last week’s rambled to over 3000, so at least this is more concise.

Let’s dive in.

Topic list:

Yet another BTC all time high

I really like my new job so far!

Bad news in El Salvador and D.C.

Good news for Bitcoin in D.C.

Big plans for Bitcoin in El Salvador:

official Economía announcement post

Another Bitcoin All Time High

Bitcoiners might seem obsessive.

Sometimes people call us a cult.

I get how it might seem like that from the outside… but we’re honestly just trying to help, and it’s frustrating as hell that so many people dismissed us as crazy when we tried convincing loved ones about Bitcoin while it was on sale at $16k.

But better slightly late than never!

There’s no stopping this train.

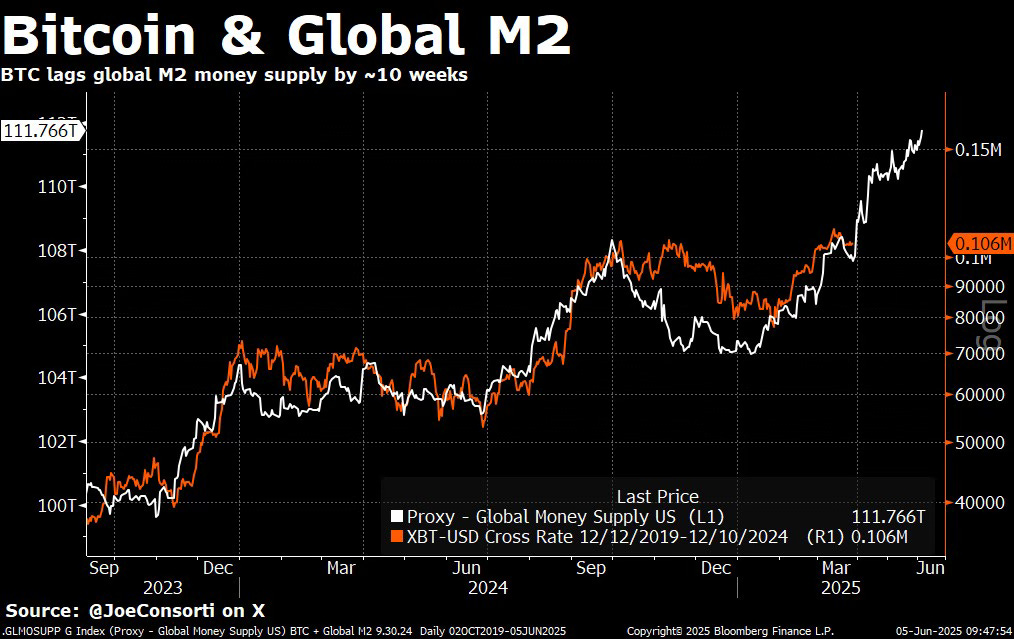

The $ price rose to $123k a few days ago.

It dipped back down after that to $118k… the same All Time High mentioned in my last post. I bought the dip, and I hope you did as well, because it’s back over $120k now.

And it’s still just getting started.

I elaborated more about the reasons why two posts ago. Read that again if you still have any doubts:

And again…

I’ll repeat this disclaimer:

My only financial advice is to avoid taking leveraged bets. That’s how people get wrecked by Bitcoin’s volatility. I personally just buy as much as I can afford with every paycheck, without taking risks.

And yes.

I’m saying WITHOUT risk.

Because the “risk” if you are stacking Bitcoin responsibly like that has never been lower.

The President of the United States’ own family companies are raising billions of dollars specifically for buying Bitcoin (and some shitcoins, but primarily Bitcoin).

Several of his cabinet members also own significant amounts. The risk of the U.S. government banning it, at least while President Trump is in office, has gone to zero.

And some of the most respected financial advisors in the world are now considering it IRRESPONSIBLE to NOT own Bitcoin.

It was funny to me seeing a couple weeks ago that Ric Edelman now recommends a portfolio allocation between 10% and 40%.

When I cofounded a “stock and finance club” in high school and my team came first place in the region, he sent us signed copies for one of his books on personal finance. I still have mine somewhere among boxes of old books.

Edelman’s financial planning firm also manages over $280 billion in assets for over 1.2 million customers.

And that’s on top of the many billionaires I mentioned two posts ago who are all publicly open about owning Bitcoin.

But it’s also not just wealthy individuals.

187 (and counting) publicly traded companies now own Bitcoin on their balance sheet. Multiple governments are known to be mining Bitcoin and/or buying it for their sovereign wealth funds.

And yeah, $120k might seem high.

I’ll admit that when we reached $123k, just out of curiosity (zero intent to buy), I looked up the cost of some expensive cars.

Suddenly most Mercedes models look cheap. If you have a full Bitcoin, hypothetically, you could buy a Benz, multiple Rolexes… and still have sats to spare.

But if you’ve accumulated that much Bitcoin, you also already understand that it would be insanely stupid to cash out now (especially for such frivolous luxuries).

Personally, I don’t ever plan to fully “cash out” into fiat. The more you study Bitcoin, the more obvious it is that BTC will become the world’s reserve currency sooner or later, because its monetary properties are objectively the best of any asset that has ever existed.

But even if you don’t fully agree with that long term prediction, you still might want to increase your current portfolio allocation.

Many signs suggest that this particular bull market cycle still has a long way left to go.

My new fiat mining job

Speaking of acquiring more Bitcoin… my new fiat mining day job is going well so far!

I explained in my last post why I left my previous job.

I’m sure I’ll elaborate more in future posts on what I like about the new role. But for now, I’ll just say that I’m confident I made the right decision.

Especially because it’s fully remote and they confirmed that it’s tranquilo to work from Latin American countries, so I’ll be able to travel more, including more time in El Salvador!

Speaking of which…

Bad news for Bukele and Trump

The past week has highlighted big ongoing scandals for each of these popular presidents.

Everyone knows about the Epstein one. It seems like immense pressure over the past week from populist right wing commentators like Tucker Carlson might be turning the tide, but the lack of transparency has risked permanent damage to Trump’s credibility, base, and 2024 coalition.

As for President Bukele’s potential scandal…

Bitcoiners already knew about the IMF deal that has severely restricted the Salvadorian government’s Bitcoin activities for the duration of the loan.

That was already far from ideal.

The news yesterday on this topic seems to make things worse. An IMF report about the deal implies that El Salvador’s Bitcoin Office has been lying about continuing to increase their Bitcoin holdings.

Their publicly viewable Bitcoin wallet has increased to a dollar valuation now worth around $750 million — more than halfway to paying off the $1.4 billion IMF loan — but now it appears that those increases were coming from secret wallets they already controlled, rather than being new purchases as portrayed.

I won’t pretend like that looks good.

But I’m not gonna dwell on it either.

Thus the title of my post.

I’m not gonna pick these battles.

I have enough going on without all that.

I’m finally reestablishing my career after the Biden administration’s covid tyranny derailed it.

I’m finally getting my Bitcoin stack to the point where I feel comfortable actually LIVING life again, instead of just stacking like a lunatic with nearly zero expenses or social life.

And on top of my day job, I’m supporting projects that can have meaningful impact for grassroots Bitcoin adoption, so others can share in the fun and the benefits!

It’s naive to fully trust any politician.

All I can reasonably expect from “the good ones” is that they preserve economic liberty and safety for free market builders to do good work without interference.

In El Salvador, Bitcoin is still essentially legal tender, with zero taxes for spending it. El Salvador still has the most widespread Bitcoin education, and it still has the most Bitcoiners per capita.

Regardless of the government’s treasury reserve, and even their possible dishonesty (assuming you trust the IMF), hardly anything has changed for grassroots medium of exchange adoption.

President Trump has also stopped the Democrats’ war on crypto. Some of my friends might be in jail, or at least expensive legal battles, if Kamala had won. Instead, now their companies and other Bitcoin initiatives are doing better than ever!

Time is the only thing that’s even more scarce than Bitcoin, and I’m not gonna waste mine by picking battles on things outside my control that would undermine my ability to make a positive impact where I actually can make a difference.

Trump and Bukele have given us room to build.

Let’s make the most of it!

Good news for Bitcoin in D.C.

Before I cover “crypto week” legislation…

Or a significant Trump admin comment…

You may recall at the end of last week’s post that I mentioned I was on my way to a D.C. Bitcoiners meetup.

That ended up going really well!

I’m sure I’ll elaborate more in a future post, but the community of genuine Bitcoiners in this area has grown significantly in the past couple of years.

And we’ve got big plans.

Including a Bitcoin 101 Q&A session on the national mall, right in front of the Capitol Building…

Possibly even a Bitcoin Farmers Market here, inspired by me wearing my shirt from the BTCFM in El Zonte to this D.C. meetup.

I’ll keep you posted.

But THIS is the “battle” that I pick.

Bitcoin isn’t ONLY the best store of value.

It’s also the best MONEY.

This post is already longer than intended, but stay tuned. Advancing medium of exchange adoption in D.C. could have world-changing impact, and it would be the honor of my lifetime to help get that ball rolling.

And oh yeah:

Trump nicknamed this past week as “crypto week” because of some legislation going through Congress.

Most of it is stablecoin distractions. It’s definitely not perfect. But at least the regulatory clarity is helpful for Bitcoin (unfortunately also shitcoin) adoption.

And more meaningfully…

A reporter from Bitcoin Magazine got to ask the first question at a White House press conference, and the Trump administration’s press secretary made a huge promise.

The “de minimis” exemption up to $600 for actually spending Bitcoin as a medium of exchange is still in play:

El Salvador is still leading the way with no capital gains tax already for using the best money as actual money… but it’s HUGE that the U.S. might be starting to make steps in the right direction as well.

Economía Bitcoin in El Salvador

As thrilled as I am that the U.S. is starting to catch up… and even despite the recent IMF related setbacks…

El Salvador is still Bitcoin Country.

Their first mover advantage was massive.

Circular economies like El Zonte (Bitcoin Beach) and Berlín have set an example that the entire world can take inspiration and lessons from.

That’s our goal with Economía Bitcoin.

I elaborated in the new official announcement post on Bitcoin Berlín’s website.

That also includes a link to early bird tickets. If you’re planning to attend, go ahead and buy your ticket before we raise prices to 75k sats on September 1st.

That’s also my self-imposed deadline to have the speaker lineup basically finalized. If you’re a good speaker at conferences, please reach out soon directly, and I’ll see if we can fit you in.

I mentioned in my last post that I’m also thinking about staying fully sober for at least a little while to focus on starting strong with my new fiat mining day job and also making this event as amazing as possible.

I’ve decided to follow through with that until at least September 1st, and probably through the event on November 22-23.

I’ve got my priorities straight.

I’m picking my battles. And I intend to win.

P.S.

I’m focused mostly on solutions these days.

But if you can’t help but still focus some on the problems… the past week has had two major developments for people who truly value freedom and truth.

Dave Smith just won yet another massive debate on the Israel-Palestine/Iran issues, this time at the big annual Turning Point USA conference last weekend.

He’ll also be going on Rogan again soon. I’m proud of Dave for carrying on the torch from Ron Paul.

The other big development was last night when Tucker Carlson livestreamed an episode with Darryl Cooper about Epstein.

Tucker and other brave, independent-minded right wing commentators have refused to let up on this issue, and it finally seems to have forced Trump’s hand, as he posted on Truth Social during the livestream that they’ll start releasing some of the Epstein documents.

Speaking of those two… Darryl cohosts a new show with Scott Horton, who was also on Tucker’s show a few weeks ago.

I’m very proud of Dave and Scott. Those two, closely followed by Tucker now, are the best antiwar voices in the entire world right now.

It was really cool meeting both of them last year at the Libertarian National Convention:

But again…

I’m focused on solutions these days.

We all have to pick our battles. I’m thrilled that Dave and Scott have picked theirs, successfully fighting for peace on the world’s biggest podcasts and conferences.

But I’ll keep focusing on Bitcoin.

Even the smaller grassroots events I’m helping to plan can still have a massive impact.

The lessons I’ve learned from El Salvador could help launch a Bitcoin farmers market to advance freedom money as a medium of exchange in D.C. itself.

(we already have some merchants interested)

And Economía Bitcoin is gathering leaders from some of the most successful “circular economy” projects throughout Latin America, in addition to entrepreneurs and educators who make it easier for more people to get involved.

Come participate on the cutting edge of the SOLUTION at Economía Bitcoin.

I hope to see you in Berlín this November!

I love reading your posts…educational, inspiring, personal, and validating. Glad the new fiat mining job is going well :-).