8/21: birthday + Bitcoin Infinity Day

Reflections on time, scarcity, and value

Today is my 28th birthday.

It’s also, coincidentally, a Bitcoin holiday:

“Bitcoin Infinity Day”

8/21 —> ∞/21m

“Everything divided by 21 million”

The phrase was popularized by author Knut Svanholm, who wrote a book with the same name, referring to the absolute scarcity of Bitcoin’s supply.

The importance of this scarcity is easiest to appreciate in contrast to the status quo:

All fiat currencies are inflationary.

The purchasing power of money you earn — a representation of the value you’ve provided for others, and the scarce amount of your time on earth traded to do so — is diluted away as a hidden tax under a Fiat Standard.

Bitcoin has many qualities.

Its most important by far is fixing THAT.

The world is unpredictable… war, politics, technological disruption. Many fundamental aspects of civilization are undergoing rapid change, and nobody knows exactly how things will look a few years from now.

Even Bitcoin’s future as a Medium of Exchange is uncertain. Don’t get me wrong… the tech itself works. One year ago today, I celebrated my 27th birthday with Bitcoiner friends in El Zonte — Bitcoin Beach, the small surfing town in El Salvador that famously pioneered the boom in “circular economies” where people actually SPEND their Bitcoin.

It was a powerfully positive time… experiencing firsthand how it IS possible to live off of this strange new “magic internet money” full time, without swapping out into fiat for spending.

Since then, unfortunately, American and European politicians have increased regulations to make that “freedom money” lifestyle less viable for their citizens without significant privacy and tax tradeoffs.

At the same time though… there’s still a powerful reason for optimism.

The “Store of Value” case for Bitcoin has never been more undeniable. It’s never been more “legitimately” acceptable. Including for those establishment institutions!

In January of this year, the U.S. government approved ETFs for investing in Bitcoin. Since then, many of the world’s biggest money managers — BlackRock, Goldman Sachs, Morgan Stanley, and many more — have started accumulating it.

Nation states are increasingly adopting it as well.

Several countries are mining Bitcoin…

El Salvador continues to add one full Bitcoin to its treasury reserve every single day…

And two of the three main candidates for President of the United States recently attended the Bitcoin Conference in Nashville, where both promised to formalize a strategic Bitcoin reserve for the U.S. treasury, with the explicit goal of helping to pay off the (rapidly increasing) national debt.

The reason is simple. In a world that’s increasingly uncertain, two things are guaranteed:

The supply of fiat currencies will continue increasing over time, with their purchasing power decreasing as a direct result

Bitcoin’s total supply will always remain perfectly scarce, with an absolute limit of 21 million

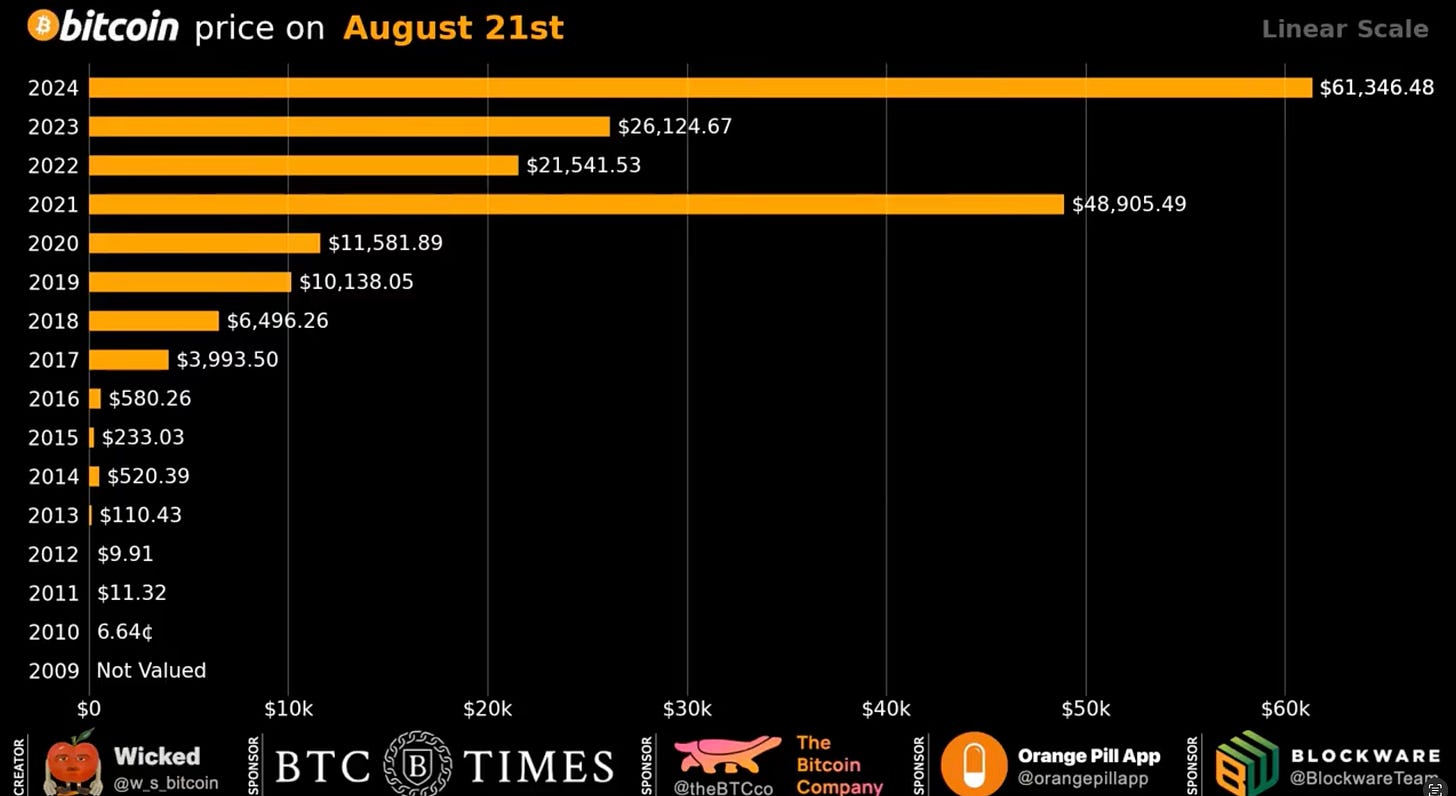

It’s still a volatile investment, but the trend over time has been clear. Here’s a chart of Bitcoin’s dollar-denominated price on “Infinity Day” over time:

And this year is a positive anomaly.

Despite previous trends, Bitcoin actually reached its all time high for this day even DESPITE the Federal Reserve increasing interest rates for a prolonged period of time.

And if the Fed finally starts cutting rates in September — as many expect — the market value of perfectly scarce sound money could boom.

I don’t know what will happen with politics… war… with the job market, with technology, with so many things rapidly changing.

But I do know this.

In a world of uncertainty, it’s mathematically certain that Bitcoin will remain perfectly scarce. And the investment case for it has never been more clear.

It’s not just me saying that either. Highly regulated and respectable financial institutions are saying it now as well.

The one bit of “financial advice” that I’ll add to the professionals’ is to recommend buying the actual asset itself, instead of the ETF.

Swan is one good exchange for investing in the real thing.

Strike is another if you want to buy on your smartphone.

Either way, I recommend taking self custody. Exchanges can be hacked or go bankrupt, so it’s smarter to control your own Bitcoin directly. I’d be happy to help readers get set up if they have any questions.

As for my birthday…

The past year has been eventful. I spent a lot of time working to advance Bitcoin adoption as a “Medium of Exchange” in El Salvador, where it’s legal tender.

The future in that regard is more uncertain now for U.S. citizens… but I do know this.

On this day next year — Bitcoin Infinity Day, when I turn 29 — I fully intend to own more of this perfectly scarce asset than I do currently.

And I encourage everyone else to set that goal as well!